Set It Once, Let Your Savings Work Every Day

Why One Session Changes Everything

Design Your Auto-Transfer Blueprint

Pick the right round-up style for your cards

Decide between nearest dollar, nearest half, or multiplier boosts on weekends. If you prefer predictability, cap daily round-ups. Travelers may pause during trips, then resume at home. The goal is frictionless accumulation that matches habits, so you keep swiping confidently while balances rise.

Supercharge micro-savings with thresholds

Set a threshold that moves round-up totals to savings once they hit a chosen amount, creating satisfying milestones. Pair with a tiny payday kicker for momentum. Visual markers beat vague hopes, reinforcing consistency through delightful completions and quiet dopamine celebrating progress every few days.

Make the invisible visible with delightful confirmations

Turn on weekly digests that summarize round-ups without overwhelming notifications. A single cheerful message showing totals, notable purchases, and progress toward goals sustains motivation. Visibility keeps the habit alive, yet noise stays low, so you appreciate growth without resenting constant buzzes or pings.

Alerts That Nudge, Not Nag

01

Set thresholds that respect your cashflow

Pick low-balance alerts that trigger before danger, not after. Calibrate to your rent, insurance, and typical weekend spending. Add high-transaction notifications for unusual charges. When messages mirror your reality, you read them, respond quickly, and build a relationship with money that feels cooperative, not scolding.

02

Transform bill reminders into calm checkpoints

Replace panic with preparation. Two gentle reminders, spaced smartly, give you time to adjust transfers or reschedule autopay. Include links straight to payment screens. The message tone matters; encouraging language keeps stress down so you handle obligations smoothly and return attention to better moments.

03

Turn unusual-activity pings into quick clarity

Fraud alerts work best when details are crisp and actions are obvious. Include merchant name, amount, and tap-to-freeze options. Fast clarity shortens worry, protects funds, and teaches you to trust safeguards, letting you shop confidently while knowing backup systems stand ready.

Buffer accounts absorb timing shocks

Overdraft shields and gentle retries

Auth, encryption, and your peace of mind

Safety, Security, and Fail-Safes

Stories From a Single Afternoon

Maya finally stopped dreading the first of the month

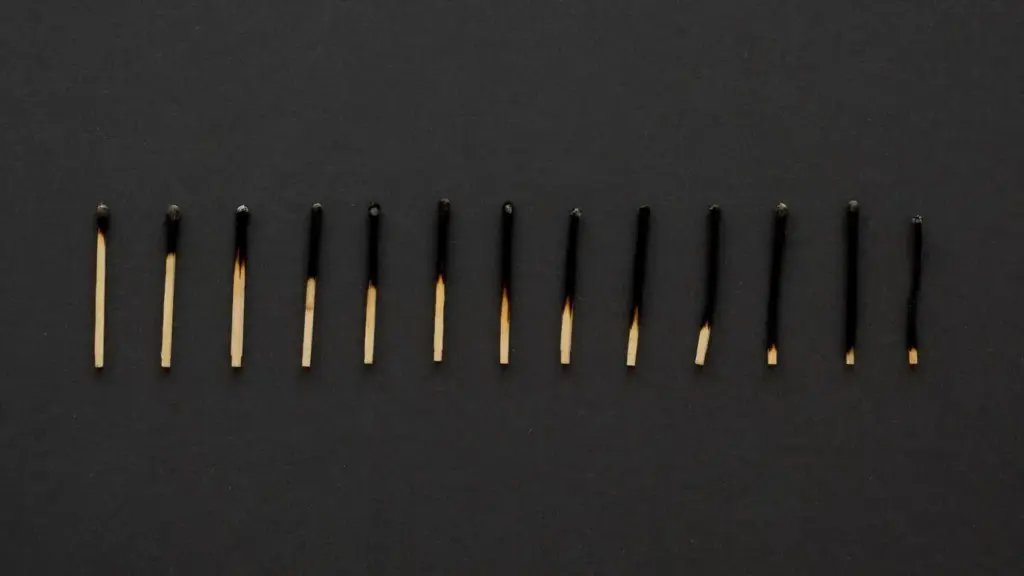

Julian found motivation in seeing progress daily

A couple aligned money with values over coffee

Keep It Alive With Tiny Reviews